Summary

Check your liability to Revenue in Sage Payroll.

Description

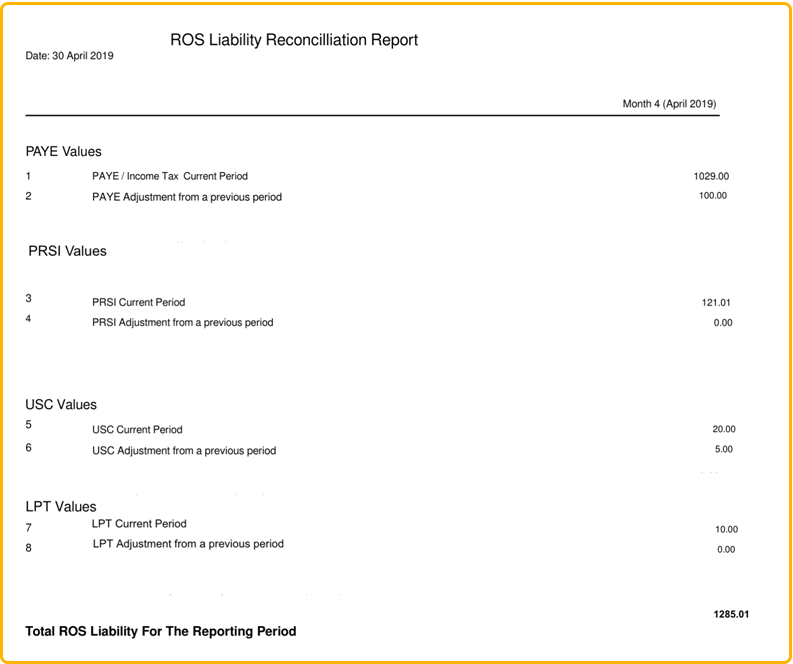

Use the liability reconciliation report to check your liability to Revenue. You can get the liability for each pay period in Sage Payroll.

Resolution

The report shows the total amount owed to the revenue and a breakdown for the selected report period.

About the report

The report is only available once all pay runs are complete for the reporting period. This can be monthly or quarterly.

- Shows a breakdown by PAYE, PRSI, USC, and LPT for reporting period, monthly or quarterly

- Shows the total amount due to the Revenue at the bottom of the report

- Once you record that you've paid the revenue for a given period, the report finalises. The values are not updated again, even if you amend a completed pay run

View the report

Current period

View the report for the current period from the Summary page. The link only displays when all current pay runs are complete.

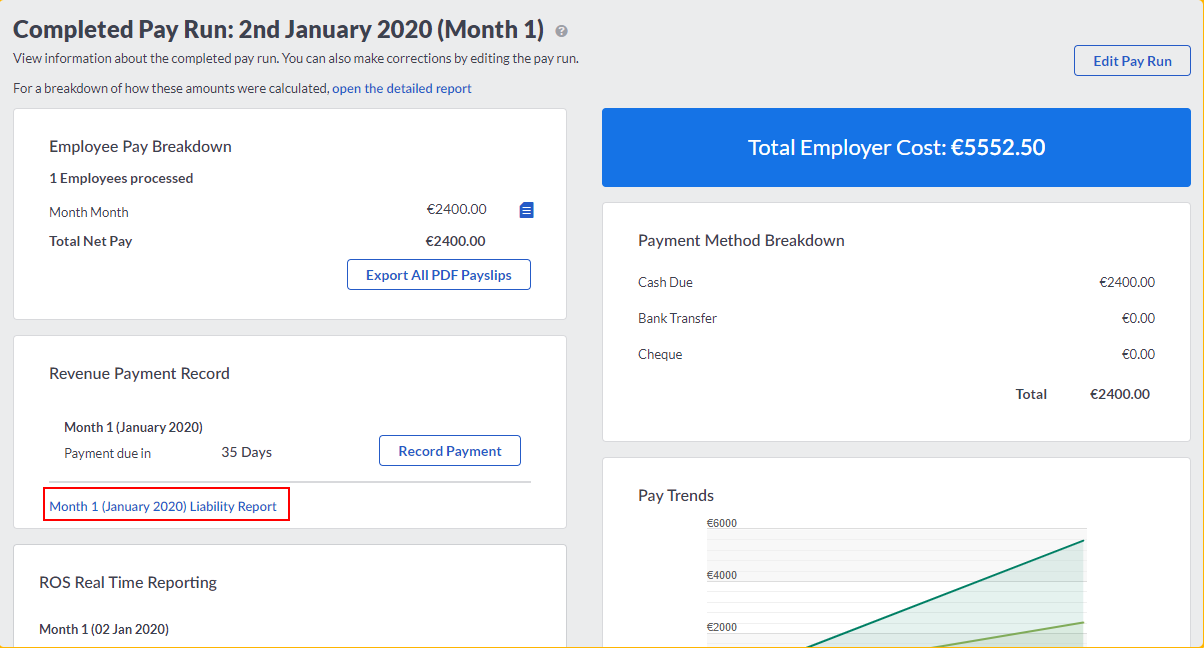

Previous period

View the report for a previous period from the Completed Pay Run page. The link only displays when all current pay runs are complete.

From Pay Runs, open the pay run for the required period.

From the Revenue Payment Record, select Liability Report link.