Import a P2C file into Sage Payroll

- Open Sage Payroll and log in to the payroll as normal.

- From the menu bar at the top of your window, click Miscellaneous, point to Tax Credit Import, then click Import Tax Credits.

- Click Browse, browse to and select the P2C file, then click Open.

- Check the summary information is correct.

NOTE: If any details appear in red, you need to address these issues before proceeding.

NOTE: If any details appear in red, you need to address these issues before proceeding.

- Click Next.

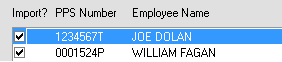

- For each active employee on your payroll, select the Import? check box.

- Click Import Now.

- To produce a copy of the P2C information for your records, click Print Tax Credit Import Report.

- Click the Select section of report to print arrow, then click the relevant option.

- Click one of the following options:

- Preview - Use this option to view the report in notepad.

- Print - Use this option to print a copy of the report.

- PDF - To create a PDF copy of the report, use this option. You can then save or print the report.

- eMail - To send the report as an e-mail attachment, use this option.

- Click Cancel, then click Done.

You’ve successfully updated your employees’ tax and USC allowances and if applicable, LPT information.

The next time you pay your employees the new allowances are used. You should spot-check a few of your employee records to confirm that the P2c tax credit information has been updated correctly.